Special Purpose Acquisition Companies (SPACs): Investment Craze or Deep State Laundry?

By Carolyn A. Betts, Esq. and Catherine Austin Fitts

“When everyone thinks central bankers, money managers, corporate managers, politicians or any other group are the smartest guys in the room, you are in a bubble.”

~ Doug Kass

“The object of life is not to be on the side of the majority, but to escape finding oneself in the ranks of the insane.”

~ Marcus Aurelius

Table of Contents

Overview

I. Introduction

II. Why Talk about SPACs?

III. What Is a SPAC?

IV. SPACs and the Going Direct Reset

V. Who’s Who in SPACs

VI. Performance/Return on Investment

VII. Coincidence or Plan?

VIII. Will SPAC Bubbles Come Again?

IX. Conclusion: SPACs, Going Direct Reset, and Planet Equity

Endnotes

Bibliography

Overview

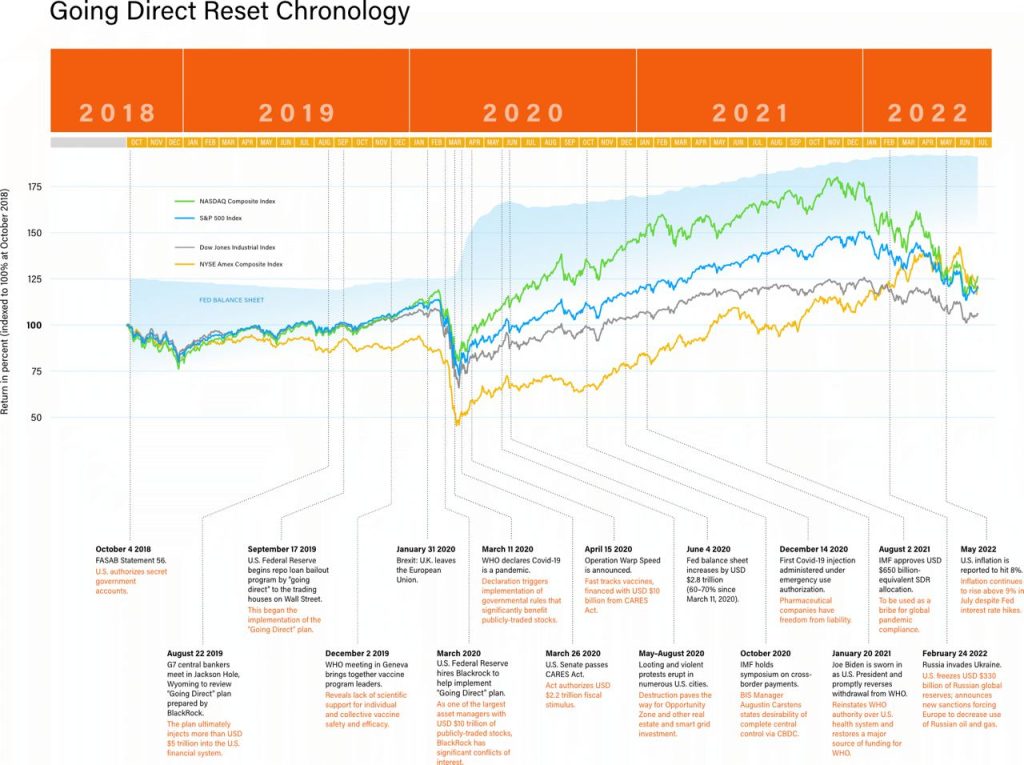

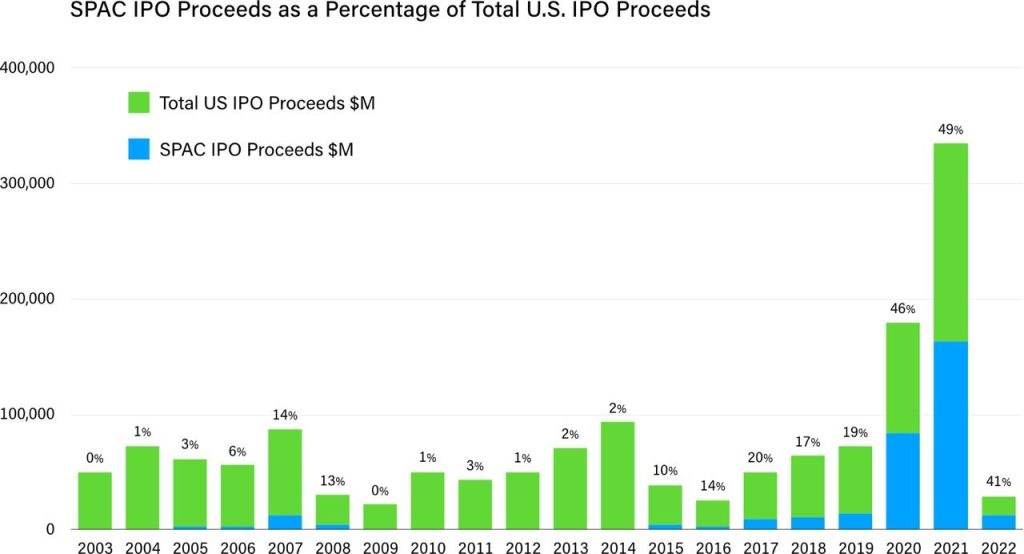

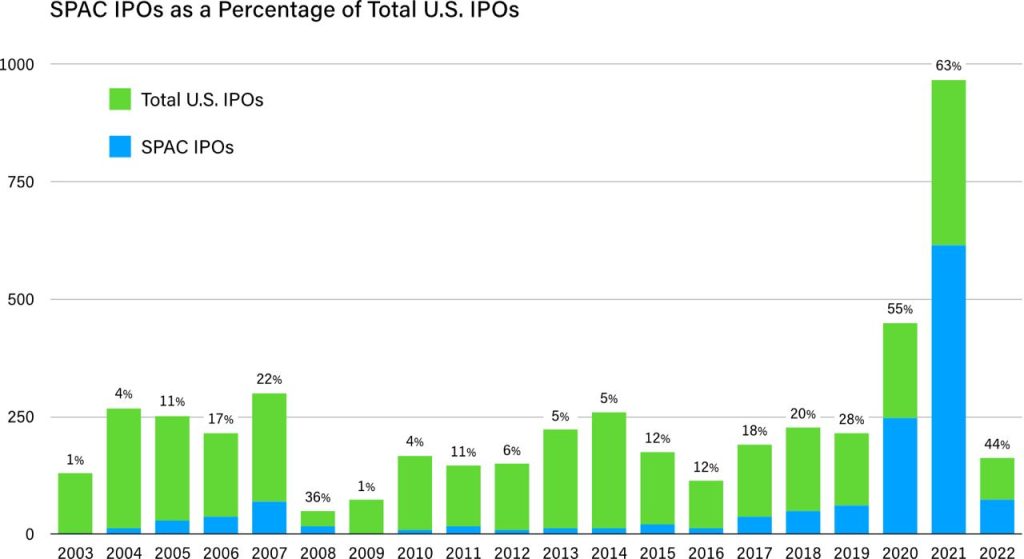

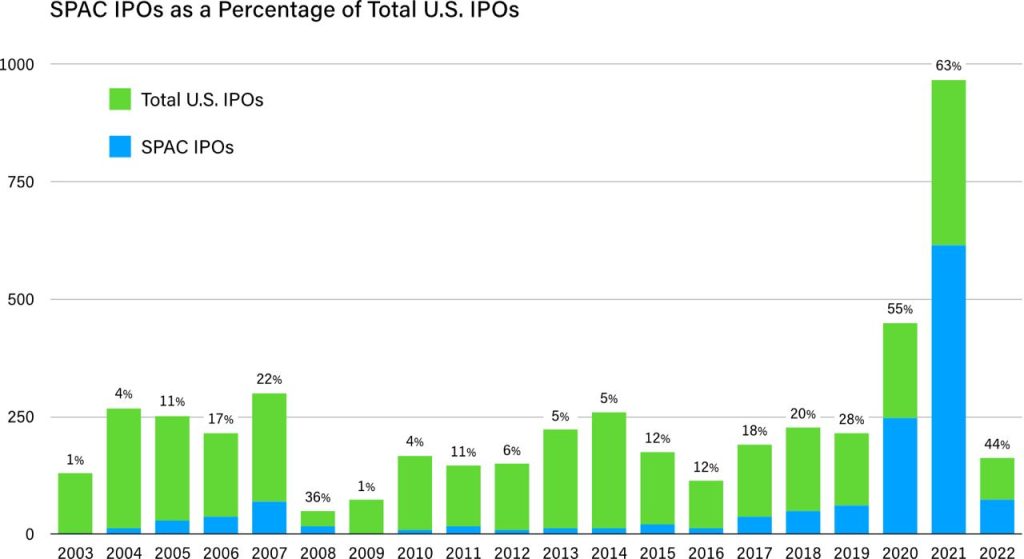

A financial coup d’état characterized by explosive financial fraud has been underway in the United States for a number of decades. Before the financial fraud started, it was unheard of for serious investors to finance blind-pool initial public offerings (IPOs). This changed in a notable way in 2020 and 2021 when the U.S. equity market pumped out several hundred billion dollars of blind-pool IPOs called special purpose acquisition companies (SPACs). As it turns out, the unprecedented two-year “SPAC bubble”—with SPACs accounting for 63% of IPOs in 2021 versus 28% in 2019—furnishes another window onto the Going Direct Reset, looking like nothing less than a plan to direct billions in blind-pool monies (and perhaps launder some of the trillions in missing money) into investments supporting the build-out of Mr. Global’s control grid. Together with a Bitcoin pump-and-dump that kept heads of household distracted as their families and communities were being harmed by Covid injections, the SPACs phenomenon seems to represent another chapter in the plan engineered at the highest levels of the central banking and financial systems to ensure a two-tier economy: “boomtown” for insiders and controlled demolition for the people.

I. Introduction

Financial fraud became a very big business in America during the 1980s. It started with the mortgage and real estate fraud that produced the Savings and Loan (S&L) Crisis.[1]From Investopedia (Savings and Loan (S&L) Crisis) on the Savings & Loan Crisis: The Savings and Loan (S&L) Crisis was a slow-moving financial disaster. The crisis came to a head and … Continue reading

In 1990-94, the taxpayers were stuck with a bill of approximately $500 billion. Catherine led part of the cleanup as Assistant Secretary of Housing at the Department of Housing and Urban Development (HUD) and got a bird’s-eye view of the mortgage and real estate fraud. At the time, it was one of the world’s greatest financial heists yet. (You can read more in “Missing Money: A Personal History – 1989 to 2019.[2] Catherine Austin Fitts. “Missing Money: A Personal History – 1989 to 2019.” The Solari Report, Apr. 7, 2019.”)

This explosion of financial fraud—condoned at the highest levels of the central bank, government, and justice systems—made financial crimes a socially respectable business. Most financial types did not want to miss out on a fat and growing fee flow.

After the cleanup of the S&L fraud and losses, the leadership added stock market and derivatives engineering to their toolkit and did it again—but this time, they were able to take the financial fraud industry to a whole new global level. The resulting financial fraud led to U.S. bailouts starting in 2008 estimated to total $24 to $29 trillion—and there were many more losses in Europe and Asia.[3]See Catherine’s book review of Bailout: How Washington Abandoned Main Street While Rescuing Wall Street by Neil Barofsky and “$29,000,000,000,000: A Detailed Look at the Fed’s Bailout of the … Continue reading That’s not counting central banks’ implementation of quantitative easing (QE) pretty much ever since.

But wait, there’s more. These losses were accompanied by documented reports of $21 trillion in undocumentable adjustments in U.S. federal government accounts from fiscal 1998 to 2015. In 1998, a spokesperson for the U.S. Department of Justice told a reporter with whom Catherine was working that the U.S. financial system was the global leader in money laundering—we were laundering $500 billion to $1 trillion a year of criminal proceeds.

A couple of years later, in 2000, the chief of staff to the senator who was head of the appropriations committees for the Treasury and HUD (then the largest issuer of mortgage insurance in the world) told Catherine that, in that individual’s opinion, HUD was being run as a criminal enterprise. Since HUD’s financial operations were run by the U.S. Treasury, the Department of Justice, the New York Federal Reserve Bank (as depository of the Treasury) and the large New York Fed member/owner banks—with the largest U.S. defense contractors running the digital systems, aided by the most prestigious accounting firm in the country—this fact had profound implications for the state of both the U.S. and global financial systems.

This was a financial coup d’état.

The coup was financed by an explosion of government and corporate debt and central banking largesse. The result was free money—easy money on a scale that was theretofore unimaginable and that had to be managed with interventions. Insiders paid interest at 0%. Outsiders borrowed at 17% to 30%.

History is clear, however: once you legalize usury, a civilization is destined to fail. You cannot have a free market function with sound pricing mechanisms when insiders enjoy a veritable tsunami of money while outsiders have to earn money the old-fashioned way. As the spigot never turns off, the tsunami of money becomes a speculative bubble that pours bizarro economics and behavior into every area of economic life.

Before the financial fraud started, blind-pool initial public offerings (IPOs) were unheard of—they just did not happen. Blind pools were things that trust fund babies got from their parents to start their first enterprise. A shyster might also offer blind pools to retail investors, but blind pools were certainly not something that a serious investor would finance.

The fact that the U.S. equity market would go on to pump out several hundred billion dollars of blind-pool IPOs—called special purpose acquisition companies or SPACs—in the last few years speaks volumes about the Fed’s injection of $5 trillion into the economy to launch the Going Direct Reset.[4] See John Titus, “Summary – Going Direct Reset.” And reading about Wall Street buying up single-family homes all over the country tells the same story.

In a financial coup, who needs an invading army? Just print money out of thin air and buy the country—one person, one asset, one home, one community, and one company at a time.

Note that for the parties involved, this is not just a financial coup but a relational database coup as well. If you are the insiders, while you are printing your takeover money, you are making sure to invest some of it to build out the complete “smart grid” infrastructure for your digital control, ensuring you will still be in charge when everyone later realizes what has happened. For that, you need lots of companies run by your pals, and you need them fast.

Enter SPACs, stage right.

II. Why Talk about SPACs?

On May 26, 2022, Catherine and Carolyn recorded an introduction to the Solari Report’s 1st Quarter 2022 Wrap Up: Special Purpose Acquisition Companies (SPACs): Investment Craze or Deep State Laundry?[5] See “1st Quarter 2022 Wrap Up: Special Purpose Acquisition Companies (SPACs): Investment Craze or Deep State Laundry?” with Carolyn Betts, Esq. As explained by Catherine in the course of this discussion, the relatively obscure subject (to most non-stock-market players) of SPACs is highly relevant to unveiling the activities—financial market and societal manipulations—of central bankers and Wall Street in carrying out the Going Direct Reset.

Note: Need a chart of top financial advisors here

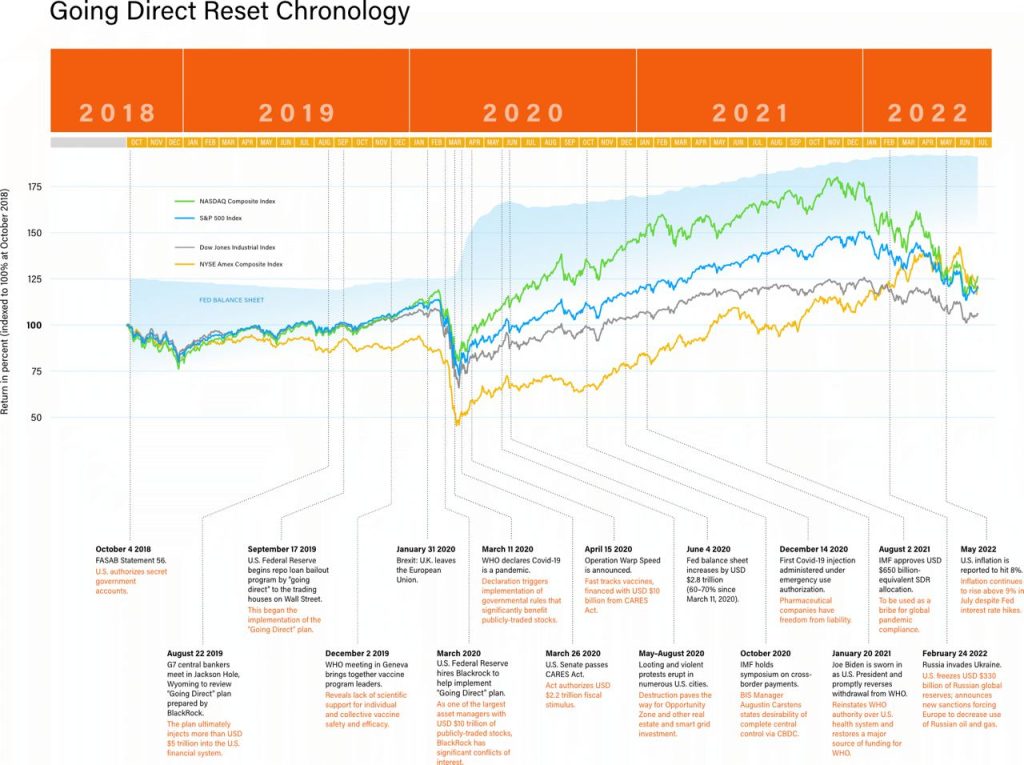

So far, the Going Direct Reset process has been characterized by events that the controlled media would describe (if the media described them at all) as phenomena that are largely unrelated, naturally occurring, and spontaneous.

Note: Incorporate Going Direct Reset chart and narrative at https://planetequity2022.solari.com/going-direct-reset/..

Far from random, these events started with the little-noted change in federal government accounting standards under FASAB 56 in October 2018 that took the position that administrative policy could supersede the U.S. Constitution and existing financial management laws and regulations to permit the federal government and its contractors to cook the books.[6] See Michele Ferri and Jonathan Lurie, “FASAB Statement 56: Understanding New Government Financial Accounting Loopholes,” The Solari Report, December 29, 2018. This was followed by the August 2019 Jackson Hole meeting by G7 central bankers to review and adopt the Going Direct Reset plan.[7]See Pam Martens and Russ Martens, “BlackRock authored the bailout plan before there was a crisis—now it’s been hired by three central banks to implement the plan,” Wall Street on Parade, June … Continue reading And in December 2019, a World Health Organization (WHO) meeting in Geneva that brought together global vaccine program leaders featured the stunning admission that there was no scientific proof that vaccines were safe and effective when administered either individually or in combination—proof deemed essential to overcome the growing resistance to vaccination (not to mention experimental gene therapy).[8] See “Look WHO’s talking! Vaccine scientists confirm major safety problems,” Children’s Health Defense, January 16, 2020.

In short, what is happening is no coincidence. The market anomalies, together with the surrounding political decision-making, point to a planned takedown—engineered at the highest level of the central banking and financial systems—rather than a naturally occurring market downturn.

While as many as one-third of U.S. small businesses were being wiped out by a false pandemic and state-mandated business shutdowns, ordinary Americans were struggling with unemployment, closed schools and “vaccine” mandates, followed by continued business interruptions and supply chain problems. This, of course, afforded remarkable opportunities for online businesses (e.g., Amazon) and “essential” businesses (like Kroger, Target, and Walmart) not subject to shutdown mandates to capture the market share of the targeted small businesses for free and buy their assets at low prices. Asset prices would have been especially rock bottom in areas targeted by “riots.”[9] See, for example, “Mapping Minneapolis Minnesota Riot Damage, Opportunity Zones, and Fed Banks (a Work in Progress).” Any attempt by small business owners to get back on their feet would later be handicapped by the predictable skyrocketing inflation and increase in mortgage and other interest rates.[10]See John Titus’s video “Toilet-flushing the U.S. in 3 Exciting Fed Colors”; see also, “Dealing with the next downturn: From unconventional monetary policy to unprecedented policy … Continue reading

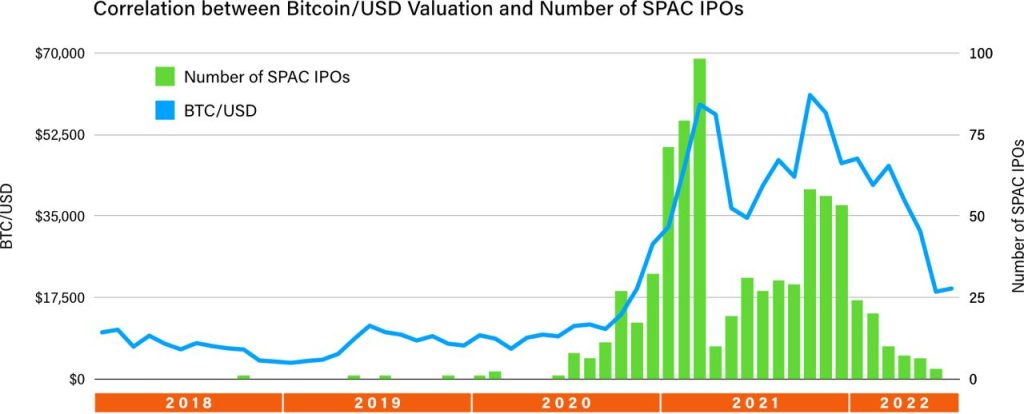

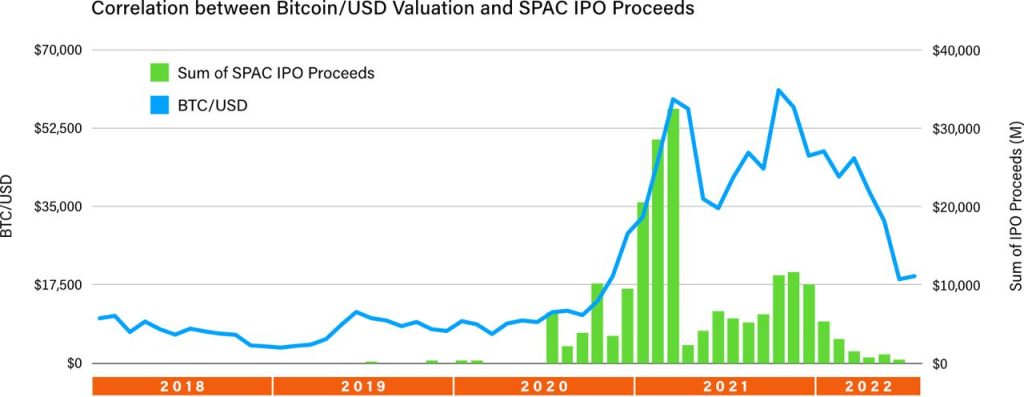

Our belief in the engineered nature of current events was reinforced when we reviewed charts of Bitcoin performance and the volume of investment in SPACs.

Note: Insert “Total SPAC Proceeds by Year” and/or(?) “Total SPAC IPOs by Year” from Note: https://planetequity2022.solari.com/spac-charts/ and list Source: SPAC Analytics

Source: SPAC Analytics

Note: Insert Bitcoin ALL Chart from https://www.bitcoinprice.com/

Note: Insert BTC/USD vs (SPAC) IPO Proceeds

Note: Insert BTC/USD vs #(SPAC) IPOs

Note: Insert BITCOIN VS ICO CHARTS

Not only was there an explosion of investment in what appeared to be speculative, high-risk “blank check” securities offerings (i.e., SPACs), but as a distraction to the younger generation, cryptocurrency (Bitcoin) prices increased over sevenfold from roughly $8,600 in January 2020 to a high of over $65,000 in November 2021. Despite having lived through numerous engineered financial pump-and-dumps before, this time it was particularly disconcerting for us to see so many (mostly) men waylaid and captured by online trading fever and greed (no doubt delivered with entrainment and subliminal programming) while their families and friends were being systematically bankrupted and poisoned. Millions of young men—the individuals who historically have been effective protectors of the family—were noticeably distracted by the “pump-and-dump.”

Make no mistake: Things have come to a head in mind-bogglingly rapid succession. In an effort to connect the dots and determine with greater accuracy exactly what is Mr. Global’s strategy in carrying out the plan to end national sovereignty and our cultural, financial, interpersonal, and individual legal freedoms established in the U.S. Constitution and numerous constitutions and basic law in 190-plus countries, we seek to gain insights into the financial manipulations observable through anomalies that we can quantify with publicly available information. The anomalies act as Mr. Global’s footprints.

We cannot overemphasize the importance of the existence of healthy public corporations in fueling our economy—providing jobs and financing innovation in a system owned and controlled by the people and their duly chosen and elected representatives. We are believers in great companies and liquid equity markets. However, for companies and markets to function, there needs to be a legal infrastructure that works—particularly related to basic monetary and fiscal policies.

Corporations are legal entities created under and subject to the requirements of state law, usually under a state’s Department of the Secretary of State. Ownership interests in corporations, generally in the form of shares of stock, are securities regulated under federal law as instruments of interstate commerce (except in the unusual case of the absence of the involvement of interstate commerce). Federally, the purchase of and trading in corporate securities are subject to onerous Depression-era federal statutes intended to instill public transparency and integrity in the purchase and trading of corporate equity and debt instruments used to finance corporate growth. However, the existence of unhealthy public banks and corporations that prosper from flagrant violations of federal financial management laws as well as from disaster capitalism engineered by government policy to grow their market share is another matter entirely, especially when laws regarding transparency, antitrust, and criminal behavior are not enforced and capital is channeled by index funds.

Was the explosion in cryptocurrency and SPAC IPO investment during pandemic times a coincidence, we wondered—the natural result of the Fed flooding the economy with $5-plus trillion, the majority of which, from everything we can tell, went into the pockets of insiders, who inevitably would reinvest their loot in the stock, bond, precious metals, real estate, and other asset markets—or was it a plan to direct the flow toward investments supporting the build-out of the control grid?

Could the vast sums invested in SPACs relate to the trillions of dollars missing from U.S. government coffers?[11] See the Solari Report’s “Missing Money” website. Does it matter? Was the SPAC method of going public—in essence, a way to take a lot of private early-stage companies public fast, and sooner than would happen in the traditional IPO scenario—a good thing? Was it a sign of a problem with existing U.S. Securities and Exchange Commission (SEC) rules that discourage solid private companies from growing through the issuance of their securities for retail investment by the public?

In an effort to answer these questions, we took a closer look at the SPAC phenomenon.

III. What Is a SPAC?

SPAC Terminology:

- De-SPAC: The process whereby a SPAC merges with its acquisition target.

- Dilution: In the context of SPACs, dilution is the weakening of the value of SPAC shares held by one group of shareholders by some action by the company, the exercise of a right inherent in the stock, or a merger. The value of SPAC shares is diluted when the company issues shares for which it receives less per share than what it received from the SPAC IPO investors. The events described herein that involve dilution of the SPAC IPO investors’ shares include the issuance to sponsors of shares for no or little value, the sale of shares to PIPE investors for less than the SPAC IPO offering price, and the exchange of SPAC shares in the merger with the target company for an amount that makes the merger transaction more favorable to target shareholders than to SPAC shareholders.[12]See also Investopedia, “The Dangers of Share Dilution,” which explains: “Share dilution is when a company issues additional stock, reducing the ownership proportion of a current shareholder” … Continue reading

- Private investment in public equity (PIPE): Additional private equity brought in after the target company is identified. In addition to or instead of PIPEs, the SPAC sponsors may negotiate the pre-merger sale of SPAC shares or units in privately offered debt, convertible debt, and preferred stock deals, thus adding additional funding with which to negotiate the merger with the target. These private deals are negotiated with large institutional investors like hedge funds and mutual funds and often involve the sponsors sweetening the deal by sacrificing a portion of their own SPAC units. Information available to Solari on private investor raises by SPACs only includes PIPE investment, however. Note that SPACs can cut private deals with institutional investors without satisfying SEC requirements for IPOs because private offerings to high-net-worth sophisticated investors are exempt from SEC registration requirements. In some cases, the amounts raised by SPACs from private offerings greatly exceed SPAC IPO proceeds, sometimes by factors of three or four times. This can be seen by comparing the values in the “IPO/Trust Size” and “PIPE Size” columns in the SPAC Table.

- Redemption: SPAC shareholders’ opt-out from an approved SPAC deal and sale of their shares back to the SPAC. The share redemption price is the price paid for the share plus interest over the period held.

- Special purpose acquisition company (SPAC): A “blank check” or shell company created to raise capital via an IPO for the purpose of merging with a private company and bringing it public; if no merger (or “business combination”) ensues within approximately two years, the SPAC is liquidated.

- Sponsor: Institutional investors, private equity firms, and executives (and sometimes athletes and other celebrities) who establish and support the SPAC in exchange for a “promote” amounting to up to 20% of the SPAC’s post-IPO shares.

- Target company: A private company acquired for merger with a SPAC in order to go public.

- Unit: A share of redeemable SPAC stock plus a fraction of a warrant (or one warrant) to purchase more SPAC shares. By convention, SPAC units generally start out at a price of $10 per unit.

- Warrant: A contract that gives the holder the right to purchase additional shares at a fixed price. Warrants, initially bundled with shares as part of SPAC units, trade separately from shares. Warrants often if not usually have an exercise price at $11.50/share

A special purpose acquisition company is a specially structured type of U.S. initial public offering by which an existing private operating company’s stock interests become available for trading,[13] For a description of the typical non-SPAC initial public offering, see Description of Traditional IPO. [14]Before the private company takes its shares public, shares are held by insiders in restricted form, meaning they cannot be sold in public markets or on exchanges. Insiders, thus, have an incentive to … Continue reading usually on an exchange like the New York Stock Exchange (NYSE) or Nasdaq,[15]According to Michael Klausner, Michael Ohlrogge, and Emily Ruan, in their article “A Sober Look at SPACs” (Yale Journal on Regulation, 2022;39:228-303, footnote 17: Some post-merger companies … Continue reading by merging into a publicly traded shell or “blank check” company (the SPAC) formed expressly for the purpose of looking for a target private operating company with which to later combine.

A sponsoring group consists of investment bankers and individuals with proven corporate management skills—perhaps as former Fortune 500 CEOs of the general type that interests the sponsors. In exchange for a percentage (often as high as 20%) of SPAC shares, the sponsoring group invests its own time and money to finance the SPAC offering expenses and due diligence and other expenses of negotiating with potential target companies.

With the assistance of an underwriter and legal counsel, the sponsoring group registers “units” in the SPAC with the SEC. A SPAC unit[16] SPAC units are usually, or at least frequently, offered at $10, and the warrant exercise price is often $11.50. consists of a share of redeemable SPAC stock and a fraction of a warrant to purchase more SPAC shares. SPAC shares and warrants trade separately in the public securities markets.

The SPAC prospectus may specify the type of industry the sponsors intend to seek in a target company, but generally there are few restrictions on the form and substance of the merger[17]For the sake of brevity, we refer to the combination transaction as a “merger,” even though the combination is sometimes achieved in the more complicated “reverse merger” or similar … Continue reading or even the size of the target.

All of the SPAC offering proceeds are put into an interest-bearing trust account, to be used for redemptions or investment in a merger target. The SPAC has 18 months to two years (which may be extended upon approval of SPAC shareholders) to find a target company and enter into the “business combination” (the “de-SPAC” process). If no business combination is achieved by the deadline, the sponsors’ significant investment in offering costs is lost. For this reason, sponsors have a strong incentive to identify a target company and close the merger transaction.

SPAC shareholders have the option to elect to redeem their shares at the time of merger at roughly their respective interests in the deposits into the SPAC trust account, plus interest, or continue to hold them. SPAC warrants may be sold in the open market or kept by the original SPAC IPO investor.

To the retail SPAC IPO investor, the SPAC investment may be thought of as a relatively risk-free short-term investment in an interest-bearing trust fund with a potential up-side if the merger terms appear attractive and the investor decides not to redeem.

SPAC statistics have shown us that, in some cases, as many as 99% of SPAC shares have been the subject of redemption.[18] See the “Shares Redeemed” column in the chart that can be found at Planet Equity SPAC Table. How can a merger take place if most of the offering proceeds are returned to SPAC IPO investors, and how does such redemption not blow the whole merger? It turns out that the SPAC IPO offering is used in a sort of “stone soup” scenario,[19]Catherine tells the following story to illustrate stone soup. A guy walks into town and he has a stone. He unwraps it. They say, “What’s that?” He says, “It’s what you use to make stone … Continue reading where the offering proceeds of the SPAC (which have an average raise of $274,545MM over the period 2019-2022 as compared to $351,329MM in the case of traditional mergers) operate as the “stone” or walking money with which to bring other, large institutional investors to the table—an enticement, or demonstration of market attractiveness of the deal and the sponsor group—for “private offerings of public equity” (PIPEs).[20]In other words, the public SPAC offering demonstrates to other market investors who might become PIPE investors in privately negotiated deals for the same SPAC shares the potential attractiveness in … Continue reading The privately negotiated offering of SPAC shares is largely shielded from the need for SEC and other public scrutiny and tends to dilute the value of shares purchased by retail investors in the SPAC IPO (due to the negotiating power of the private institutional investors to cut more favorable terms than are available to retail investors).

A visual illustration of the steps in the typical SPAC transaction is shown in the “SPAC Process” figure below.

Note: Insert https://planetequity2022.solari.com/spac-process/

A summary of the pros and cons of a SPAC deal—as compared to the traditional IPO offering—is available at the Solari Report’s 1st Quarter 2022 Wrap Up website.[21] See “SPAC Pros and Cons.”

IV. SPACs and the Going Direct Reset

Note: Insert bar charts from https://planetequity2022.solari.com/spac-charts/

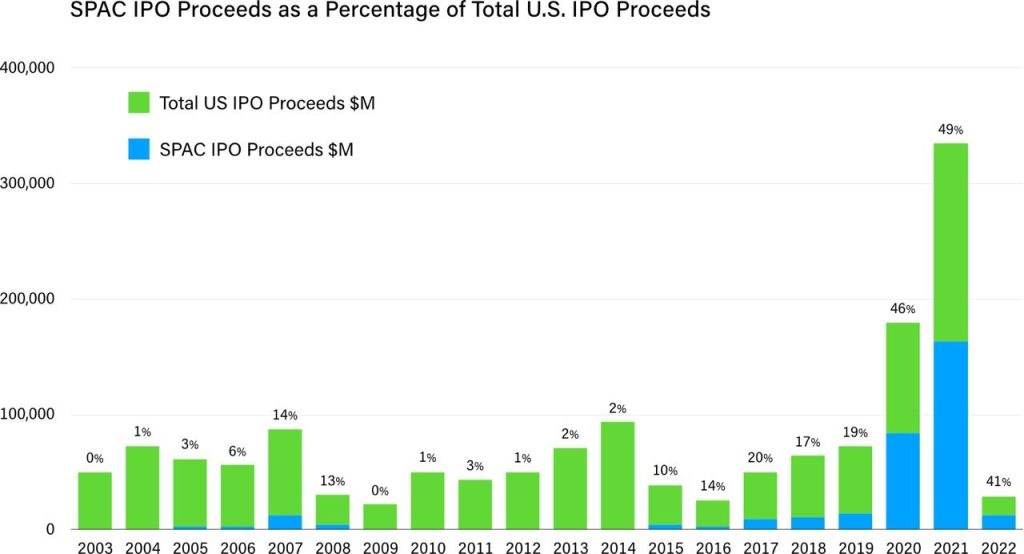

We can see from the foregoing bar charts and supporting data (provided at SPAC Analytics) that the volume of proceeds from SPAC IPOs (which, recall from Part III, do not include amounts raised by SPACs from PIPEs and other forms of private equity investment) increased six-fold from $13.6 billion in 2019 to $83 billion in 2020 and then doubled to $162 billion the next year.

SPAC IPO proceeds accounted for an increasing percentage of total IPO proceeds over that period, too. As a dollar percentage of total IPO proceeds, SPAC proceeds increased from 19% in 2019 to 46% in 2020 (that is, as pandemic lockdowns were put into place).

In terms of numbers of deals, SPACs accounted for only 28% of IPOs in 2019 but 55% in 2020 and 63% in 2021. Thus, across all the “2019-20 merger cohort” examined in the seminal article “A Sober Look at SPACs,”[22]Klausner et al., 2022, “A Sober Look at SPACs,” available at https://openyls.law.yale.edu/bitstream/handle/20.500.13051/17930/06.%20Klausner%20Article.%20Final.%20228-303.pdf?sequence=5. An … Continue reading

SPAC IPO proceeds ranged from $39 million to $690 million with a mean raise of $251 million and a median raise of $220 million. This compares with the average IPO offering of $363 million. When we take into consideration that the size of PIPE raises could be greater than the IPO proceeds in a SPAC transaction, we can see the amount of investment pouring into SPACs during 2020 and 2021 is more than an unusual, naturally occurring market phenomenon.

Let’s look at what market conditions and events comprising the Going Direct Reset occurred around the time of this boom in SPAC investment.

Note: Insert stock chart at https://planetequity2022.solari.com/going-direct-reset/

The Going Direct Reset has been characterized by events that, as already noted, the controlled media would have us believe are largely unrelated, naturally occurring, and spontaneous. These events include the following:

- The Covid-19 pandemic and ensuing state-ordered shutdowns that caused the closure of up to one-third of U.S. small businesses[23]Kamala Harris famously declared that one-third of small businesses closed during the pandemic. Later estimates were lower. An Austin-American Statesman fact check article (Fact-check: Have one-third … Continue reading while preferred, control-grid businesses like Walmart and Amazon were declared to be “essential” and, therefore, became the recipients of most American spending for most of a year, starting in March 2020.

- The creation in the U.S. of $2.2 trillion from thin air as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act “rescue plan,”[24] CARES Act Wiki. allegedly necessary to address pandemic-shutdown-related unemployment, followed by President Biden’s $1.9 trillion American Rescue Plan Act,[25] See, for example, President Biden Announces American Rescue Plan. For a funding breakdown of the American Rescue Plan Act, see the National Association of Counties website. both of which would inevitably lead to massive inflation.

- The continued Great Poisoning in general of food, water, air, and natural resources essential to the support of human, plant, and animal life.

- A campaign through overt and indirect force to inject world populations with largely untested, experimental, mRNA and other substances of unknown content, the lethal effects of which are only beginning to manifest themselves and which may prove to cause permanent heart damage, infertility, strokes, and other life-threatening and disability-causing medical harms, including neurological damage.

- Political unrest that pits special-interest groups and political factions against each other in a divide-and-conquer strategy that masks and diverts popular attention from the greater attack on their interests by a very small but powerful, nefarious outside force bent on their mutual destruction.

- Disaster capitalism through weather and climate manipulation—fires, storms, flooding, drought, ecological disruptions, species elimination, and iceberg shrinkage.

- Asset-stripping of government (the “missing money” problem we have described in various Solari Report commentaries, Wrap Ups, and interviews, most notably at The Missing Money).

- Control of the general population using entrainment, one person at a time,[26] See Catherine Austin Fitts, “Control Is One Person at a Time,” Solari Report, January 14, 2022. and using private information amassed in central blockchained and interactively connected databases to overtly and covertly blackmail political and corporate leaders and key decision-makers.

- Propaganda and cover-ups promulgated by big media.

- Development of AI and robotics as a means of reducing individualized human decision-making and eliminating the need for human labor and independent expertise.

As mentioned in Part II, the first event we identify in the Going Direct Reset is the issuance in October 2018 of FASAB Standard 56,6 which enables the federal government and government contractors to cook the federal government books, thus obfuscating questionable money movements throughout government and the financial statements of public government contractors behind the national security shield. With $21 trillion and counting in missing government money[27] See “DOD and HUD $21 Trillion Missing Money: Report & Supporting Documentation.” looking for a place to land, could it have been possible for Mr. Global to have managed to launder the missing money into investments in SPACs and, in a “twofer,” jumpstart the going-public of favored businesses that would enhance Mr. Global’s control though designated management teams free to shop with blind-pool funding?

SPACs appear to have been a means of creating an unusually large number of newly public corporations within a short period of time during the pandemic—while few were paying attention and both government agencies and the private market players (like underwriters, lawyers, and accountants) as well as SEC staff needed for completing the IPO process were working from home. Conveniently, as we will see in Part VI, many of those newly public corporations were concentrated in business sectors—such as electric cars, space, biotech, and technology—that support the expanding control grid.

The issuance of FASAB 56 was followed in August 2019 by the meeting of G7 central bankers in Jackson Hole, Wyoming, to review the Going Direct Reset plan presented by BlackRock. The very next month, the Fed began its repo direct loan bailout program by “going direct” to Wall Street trading houses (see John Titus’s analysis of “going direct” by the Fed4 and its inevitable effect on inflation10).

The WHO meeting in Geneva that brought together the world’s vaccine leaders took place in December 2019, and the next month (January 2020), the UK exited the European Union. In March 2020, with the Covid-19 pandemic descending upon the world and ushering in state-mandated business and school shutdowns and massive lay-offs of U.S. labor, the Fed hired BlackRock to implement the Going Direct Reset and Congress passed the CARES Act, thereby injecting trillions of dollars directly into the U.S. economy through direct Fed action. While some of the direct funding by the Fed was used to make cash payments to taxpayers and forgivable loans to small businesses, the net result was a devastation of family businesses and income.

As part of our quest to discover the real cause of the SPAC phenomenon, an inquiry into the players involved is useful. In this inquiry, we will discover the usual suspects in and around the New York Federal Reserve Bank (which manages multiple roles for the Federal Reserve System and the U.S. Treasury) populating the landscape.

V. Who’s Who in SPACs

The cast of SPAC-facilitating characters for which publicly available information is available includes the following:

- Sponsors

- Underwriters

- Trustees

- Auditors

- Financial advisors

- Law Firms

- Retail SPAC IPO investors

- PIPE Investors

- The (target) venture capitalists who got the exit

We make reference to detailed tabular data for the approximately 1,290 SPACs issued in the U.S. over the period from March 2016 to May 2022, available on the Solari Report website at “SPAC Table.”[28] See SPAC Table. Target and deSPAC-related data for the 276 SPACs that completed the deSPAC process during that period can be found at “Selected DeSPAC Data.”[29] See “Selected DeSPAC Data” in DeSPACS.

The Sponsors

Sponsors of SPACs have run the gamut from former Wall Street bankers to former CEOs of Fortune 500 companies, hedge funds, celebrities, and ventures comprised of members of these groups. For example, Michael Klein, former Citigroup Vice-Chairman and current director of Credit Suisse, as chairman of M Klein & Company has formed six SPACs under the Churchill Capital name; Social Capital Hedosophia, a venture between two investment firms, has sponsored at least seven SPACs. A review of the “Prominent Sponsor” column in the SPAC Table reveals more information on these sponsors.28

The Underwriters and Financial Advisors

Note: Insert selected data from Underwriter league table https://planetequity2022.solari.com/spac-underwriters/

Note: Insert NY Fed Members and Prime Dealers at https://planetequity2022.solari.com/new-york-fed-members/

The underwriters of SPAC deals are for the most part the same leading Wall Street investment banking firms with the expertise and experience from their roles in traditional IPO and merger transactions. Note the crossover of New York Fed-member banks (who are also owners of the New York Fed) and prime dealers with prominent underwriters of SPAC transactions. This crossover was in line with our expectations and confirms our suspicion that the leading role played by Fed-aligned banks—including those acting as agents for investment of U.S. government funds—is the same for the management of both the Going Direct Reset and the SPAC explosion.

The firms that served as financial advisors to various parties in SPAC transactions (i.e., SPACs, private equity investors, and targets) were concentrated among the same investment banking firms that underwrote SPAC transactions, with no notable outsized leading roles among them.

Note: Need a chart of top financial advisors here

The Trustees Holding SPAC Proceeds Trust Accounts

Even we were surprised by the concentration of control of SPAC offering proceeds (presumably including massive amounts raised through PIPEs) pending investment of such funds in mergers with target companies. Our albeit cursory examination of trust provisions in selected SPAC prospectuses reveals similar trust arrangements and shows that it was the norm for JPMorgan Chase, through arrangements with Continental Stock Transfer, to hold the offering proceeds. The Continental Stock Transfer web page says it has been “the industry-leading SPAC administrator since 2003” and has handled over 95% of the SPACs brought to market over the past 19 years. Leading SPAC sponsors Churchill Capital and Social Capital Hedosophia (sponsor of the SPAC that merged with Virgin Galactic) disclose in SEC filings that Continental Stock Transfer was to hold SPAC trust proceeds at JPMorgan Chase.

Is it possible that a significant portion—if not all—of SPAC proceeds were held by JPMorgan Chase? This would not surprise us. For those not familiar with JPMorgan Chase’s background in engineering large financial movements, including criminal ones, we recommend these two Solari Report resources: “JPMorgan Chase: Selected Legal, Regulatory, and Enforcement Settlements, 2002 to 2019”[30] See “JPMorgan Chase: Selected Legal, Regulatory, and Enforcement Settlements, 2002 to 2019.” and “JP Madoff with Helen Chaitman.”[31] See “JP Madoff with Helen Chaitman.”

The Auditors

Note: Insert abbreviated auditor league table now at https://planetequity2022.solari.com/spac-auditors/

We would describe the centralization of the SPAC market auditor function as “breathtaking.”

According to SPACInsider,[32] https://spacinsider.com/ Marcum LLP is the leading SPAC auditor by a landslide. In 974 SPAC transactions over the period examined (from 2019 to date), Marcum LLP was the auditor for 491 deals (38.0%–48.7% annual market share), followed by WithumSmith+Brown with 356 deals (22.9%–55% annual market share). No “big” auditing firm held a significant portion of the business of auditing SPAC transactions. KPMG’s market share, by number of SPAC deals, varied between 2.2% and 3.2% over the period 2019 to present.

It is consistent with our theory as to the impetus for the SPAC explosion phenomenon that a tightly knit group of professional CPA firms with expertise and experience in the complexities of managing and completing SPAC offerings and business combinations would dominate the work of financial reporting and auditing of the lion’s share of SPACs.

The Law Firms

Note: Insert abbreviated version of law firm league table from https://planetequity2022.solari.com/spac-legal-advisors/

Legal work for SPAC IPOs appears to be evenly spread among Wall Street firms that are the usual players in major Wall Street IPOs and mergers. It appears to us that Mr. Global thinks it best to share the wealth.

Slightly notable is the fact that Kirkland & Ellis, a firm originally out of Chicago, dominates the field. Its home web page trumpets “News & Insights: Coronavirus (COVID-19),” with all other matters relegated to subsidiary links. Kirkland & Ellis is reported by Wikipedia to be the world’s largest law firm by revenue. Wikipedia notes, “(w)hile Kirkland & Ellis was historically considered a firm focused on litigation, during the 2010s, it expanded private equity and restructuring practices which, together with large-scale commercial litigation, comprise the core legal service areas of the firm.”[33] Kirkland & Ellis. U.S. Supreme Court Justice Brett Kavanaugh is a Kirkland & Ellis alum, as are Ken Starr and a number of high-level Trump Administration political and judicial appointees (William Barr, Alexander Acosta, Alex Azar. Jeffrey Rosen, and John Bolton). Notable clients of Kirkland & Ellis include Jeffrey Epstein, Brown & Williamson, and Bristol-Meyers Squibb.

The Venture Capitalists Who Got the Exit from Private Target Investment

We found no public information in SPAC databases (which are largely created to appeal to investors in SPAC shares, without emphasis on target insiders) on who the venture capitalist investors in the private target companies that went public through SPAC mergers are. Target company proxy statements and registration statements (when applicable) have information on the largest target shareholders.[34]Note that some target company SEC filings are linked on the DeSPAC Table at Planet Equity DeSPAC. The proxy statements filed by target companies when shareholders are to vote on proposed SPAC mergers … Continue reading

As a result, some of the most important questions we have on SPACs are unanswered. What private investors and venture firms got taken out by SPACs, and how rich were their returns? After take-out, into whom and what did they reinvest? Were those reinvestments their decision or at the request of the decision-makers who authorized the SPAC investment itself?

The SPAC Share Investors

Retail investors in SPAC IPOs are primarily institutional investors,[35]The dominance of hedge funds in the purchase of SPAC shares and warrants is confirmed in the March 11, 2022 article in Institutional Investor, “As SPAC bubble burst, hedge funds doubled their … Continue reading although we have heard anecdotal evidence of brokers mercilessly hawking SPAC IPO shares to Solari Report subscribers and other retail investors. SPAC IPO investors are often short-term investors who view the SPAC investment as a type of secure, money-market-type parking place for funds pending other long-term investment and possibly also long-term investors who hope for up-side potential in favorably negotiated merger transactions.

According to Institutional Investor,35 London-based hedge fund Marshall Wace is the top owner of SPAC shares among hedge funds, concentrating on SPACs sponsored by private equity firms Apollo, KKR, and Fortress as well as by Michael Klein’s Churchill Capital, Goldman CEO Gary Cohen, and Bill Ackman (of Pershing Square Tontine Holdings fame). Other big hedge funds in the SPAC IPO market include SABA Capital Management (a registered investment advisor, founded by former Deutsche Bank credit default swap arbitrageur and London Whale profiteer Boaz Weinstein), Millennium Management (which announced the return of short-term class shares as part of a strategy switch to long-term class investments with redemption limitations), and Citadel LLC (founded by Ken Griffin, known for engaging in aggressive investment strategies and barring or limiting hedge fund capital withdrawals during times of economic stress). Additional hedge fund SPAC Mafia members include Glazer Capital, D.E. Shaw, Magnetar Financial, Aristeia Capital, Periscope Capital, Radcliffe Capital, and Sculptor Capital.

Redemptions of SPAC shares play a major role in merger structuring; consequently, sponsors (who often turn into SPAC executives and members of SPAC boards of directors) have major incentives to talk SPAC investors into refraining from redeeming their shares when the merger candidate is announced. It is notable, therefore, that there are many completed SPAC transactions in which more than 90% of SPAC shares have been redeemed at deSPAC. This indicates that either (1) investors thought the merger was a bad deal or (2) SPAC unit investors were investing only to park money (or to assist sponsors in the stone-soup process) and intended from the outset to redeem instead of riding through the business combination with the target.

In any case, the recent history of SPACs indicates that little in the way of short-term profits have been had by SPAC investors who continued to hold their shares through merger. According to “A Sober Look at SPACs,”22 the median proceeds of a SPAC IPO in the cohort examined are approximately $220 million, but at the median, 73% of those proceeds have been returned through investor redemptions.[36]See “A Sober Look…,” page 9. This compares with the median cash delivered to the target of $151.6 billion (71.5% as a percentage of SPAC IPO proceeds) and a median target post-merger … Continue reading

The PIPE (Private Investment in Public Equity) Investors

Note: INSERT from https://planetequity2022.solari.com/top-pipe-investors/

Data available to us regarding the identity of investors in PIPEs is in aggregate form for each SPAC and is limited to the years January 2021 to date. Therefore, we are not able to determine the respective shares in each PIPE held by individual PIPE investors. In our data, we have elected to attribute the full amount of each PIPE to each reported PIPE investor (thus over-reporting total PIPE proceeds, the actual amounts of which are available elsewhere) instead of allocating the full amount of each PIPE equally among the PIPE investors.

The following are the top ten PIPE investors by size of PIPE in which invested:

- Fidelity

- BlackRock

- Counterpoint Global/Morgan Stanley

- Mubadala Investment (an Abu Dhabi sovereign wealth fund manager)

- Franklin Templeton

- T. Rowe Price

- Institutional Investors

- Altimeter Capital

- Wellington Management

- Neuberger Capital

Thus, we see that mutual fund companies (companies that also manage pension fund investments and other pots of money—thus, it’s not clear that they are coming in through mutual funds, as opposed to mutual fund companies) play a key role in SPAC PIPE investment, along with hedge funds and a sovereign wealth fund.[37] In this regard, see Jon Sindreu, “It’s official: SPACs are the new money-market funds,” The Wall Street Journal online, February 9, 2022 .

The following chart illustrates the industries in which the investments of PIPE investors in SPAC target companies fall. In the process of negotiating their private deals with SPAC sponsors, SPAC PIPE investors (unlike SPAC IPO investors) have the opportunity to review confidential deSPAC target company financial information and, therefore, can target their investments by industry.

Note: Insert chart from https://planetequity2022.solari.com/top-pipe-investors/

VI. Performance/Return on Investment

Calculation of return on investment for SPACs is tricky, if not impossible, and the results vary according to various assumptions regarding the role of warrants and rights, among other things. Too, results are early and spare for the major volume of SPAC investment, which only peaked during 2020 and 2021, since SPACs generally do not complete a business combination for up to two years (occasionally longer) after the closing of the blank-check offering.

With that in mind, it is possible to glean some inkling of SPAC performance by referring to the table of “Top Performing SPACs” found at SPAC Analytics. Unsurprisingly, among the top five performers are an early (2007) SPAC that became a satellite communications investment in Iridium Communications and the Digital World SPAC for Donald Trump’s social media company.[38]This is an outlier among SPACs, due to the fact that much of this investment, and, therefore, the run-up in stock price, is due to politically motivated support for former President Trump. … Continue reading

The excuse of the immaturity of the deSPAC performance notwithstanding, short-term SPAC performance for those who have not redeemed their SPAC shares has been relatively dismal compared to the performance of traditional IPOs, where it is not uncommon for underwriters to leave money on the table in favor of their preferred clients’ enjoying “pop” in share price following public availability in the secondary markets. The “Annual Return” column of the DeSPAC Table is largely populated with negative numbers for good reason. The authors of “A Sober Look at SPACs” attribute this early poor performance to the significant and characteristic dilution of SPAC shares that is built into the SPAC structure—dilution particularly in the shares purchased by retail investors in the SPAC IPO due to the relatively better deals cut by sponsors (with their share in the IPO typically being 20%), PIPE investors, and target company shareholders.

According to the authors of “A Sober Look at SPACs” (whose conclusions are based upon an examination of the 47 SPACs that merged between January 2019 and June 2020), while SPACs issue shares for roughly $10 and value their shares at $10 when they merge, as of the time of a merger, the median SPAC holds cash of only $5.70 per share, and SPAC share prices tend to drop by one-third of their value or more within a year following a merger.22 Generally, as one might predict, SPACs sponsored by large private equity funds and former Fortune 500 CEOs and senior executives are, on average, more successful than others. Yet, as the SPAC IPO market becomes oversaturated, there are too few attractive target companies chased by too many SPACs. The “Sober Look” authors conclude that it is primarily the investors who hold SPAC shares at the time of the merger who are footing most of the bill for SPACs; for the targets, SPACs are a cheap method of going public.[39] A Sober Look…,” page 233. The median annualized return on investment for redeeming SPAC IPO investors in the “A Sober Look” 2019-20 merger cohort is 11.6%.[40] “A Sober Look…,” page 248.

Why, then, are major hedge funds that are reasonably expected to prioritize profit-making for their clients investing so heavily in SPACs? Is it because they view these investments as long-term winners despite short-term paper losses, and is it for this reason they are taking steps to limit short-term redemptions? Or is it because they are channeling money provided by hidden players?

VII. Coincidence or Plan?

Let us consider whether the 2020-2021 SPAC IPO explosion might have been part of Mr. Global’s plan. The following characteristics would have amounted to a plan for continuing the process of establishing a global control grid:

- Many new digital control-grid-positive companies brought public through IPOs consummated in relative secrecy with private funding.

- Lots of money to specific sectors—for example, space-related, AI-related, and central control-related industries.

- A means for illegal or unreported government (including “missing”) money to be laundered into legitimate businesses.

- SEC restraint in equalizing treatment of SPACs to that of traditional IPOs from a rule-making and enforcement perspective until after completion of the onslaught of investment during 2020 and 2021 (see below).

- The prospect of laundering funds through other countries—some targets are foreign companies (e.g., Grab) and some investors have some connection to sovereign wealth funds (e.g., Mubadala).

Conveniently, in March 2022, the SEC issued proposed regulations that, if adopted, would close virtually all loophole advantages of SPAC IPOs over traditional IPOs. If adopted, the proposed regulations[41] For a summary, see “Proposed SEC Regulations.” would require:

- More disclosure by SPAC and target, including about:

- sponsor compensation

- conflicts of interest

- potential for dilution of share value

- Fairness statement by sponsors

- Target liability as co-registrant (i.e., signing liability)

- Safe harbor no longer available for financial projections

- Target acquisition counting as the sale of security to SPAC shareholder (thus, imposing antifraud liability)

- Target financial statements under Public Company Accounting Oversight Board standards, not Generally Accepted Accounting Procedures[42]Public Company Accounting Oversight Board (PCAOB) auditing standards (see PCAOB) are stricter than the Generally Accepted Accounting Principles (GAAP) established by the Financial Accounting … Continue reading

- Stricter financial reporting generally

The slowing-down of SPAC activity during the first half of 2022 may be attributed in part to market concern that SPACs will become less attractive with the adoption of the proposed regulations. Releases by the SEC on treatment of SPAC warrants as debt and other accounting considerations also may have contributed to the cooling of the market for SPACs.[43]See John Coates and Paul Munter, “Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies (‘SPACs’),” SEC, April 12, 2021, and … Continue reading

VIII. Will SPAC Bubbles Come Again?

During pandemic-time, while the populace was obsessed with Covid-19 and dealing with pandemic restrictions and resulting layoffs, economic hardship, and educational and business disruptions—as is characteristic of disaster capitalism scenarios—and also with trying to stop the injection mandates, most people did not notice this couple of hundred billion dollars swing by. In other words, while everyone was distracted, a couple of hundred billion dollars went from here to there. Something big happened, referred to as the “SPAC bubble” in market circles. And, as is the case with virtually all bubbles (of recent vintage, at least), the elites among us benefited and the people suffered.

The moral of the story is: Never say that we are in the middle of an economic collapse or that there is no money because in the 2020-2021 SPAC IPO story, a whole sector experienced boomtown.

Could another SPAC boom take place? Given that in mid-2022 there appears to be an enormous backlog of SPACs looking for suitable targets and probably a scarcity of private companies in almost-ripe condition for going public, and in light of the new SEC regulations on the horizon—which, if adopted in anywhere near the form proposed, will likely take the wind out of the sails of potential sponsoring groups—we think it is unlikely the boom in SPAC IPOs will resume in the near future. Market economics breeds up productive companies, not financial tsunamis.

Nevertheless, history tends to repeat itself where Mr. Global is concerned, just in slightly different forms. The pandemic story is being resold in stories about monkeypox and an AIDs reoccurrence. We also hear about the potential for climate change bonds, a green energy technological revolution, and driverless transportation systems just around the corner. Moves to encourage the elimination of cash—ranging from engineered coin shortages[44] See “Titus Unpacks the Lies on the US Coin Shortage.” to closed ATMs to banks questioning depositors’ decisions to withdraw large amounts of cash—in favor of central bank digital currencies (CBDCs) as well as the further digitization of every aspect of our lives and a reduction in the need for human labor all point to Mr. Global’s desire for total control over populations. These actions also point to the potential for continuing genocide, whether achieved by weather control, lethal injections, the Great Poisoning, and central control of food, water, and air—or by the government’s takeover of individual medical decision-making.

IX. Conclusion: SPACs, Going Direct Reset, and Planet Equity

We refer readers back to the Going Direct Timeline[45] See “Timeline of Key Economic Events of the Going Direct Reset.” and our various Solari Reports on the build-up of the smart grid. Planet Equity continues—collapse and boom at the same time. The two parts of a politically managed economy include controlled demolition for the people, on the one hand, and boomtown, on the other (for Mr. Global). How this feels depends on which camp you are in.

If Mr. Global can reengineer our economy without major opposition, we as a people will continue contributing to the control grid without realizing it. The challenge is to find productive uses for our money and talents without building or investing in our own digital concentration camps.

Addendum: August 2022

On July 12, 2022, Barron’s reported that Bill Ackman’s $4 billion Pershing Square Tontine Holdings (PSTH) SPAC was liquidating after having found no merger partner [46]Lina Saigol, “Bill Ackman winds down $4 billion SPAC after failing to find suitable target.” Barron’s, Jul. 12, 2022. Ackman is quoted as explaining:

We launched (internal hyperlink omitted) PSTH in the depths of the pandemic because we believed that the capital markets would likely be impaired from the economic uncertainty created by the pandemic…. The rapid recovery of the capital markets and our economy were good for America but unfortunate for PSTH, as it made the conventional IPO market a strong competitor and a preferred alternative for high-quality businesses seeking to go public.

Then, Bailey Lipschultz Bloomberg online in an August 9, 2022 article [47]Bailey Lipschultz. “Billionaire Sam Zell-backed SPAC to return cash to investors.” Bloomberg, Aug. 9, 2022. by Bailey Lipshulltz [48] https://www.bloomberg.com/authors/AS35PgNdMGI/bailey-lipschultz reported that Sam Zell’s Equity Group Investments SPAC was returning cash to investors after failing to enter into a merger deal.

On August 16, 2022, Wolf Richter of Wolf Street reported in an article [49]Wolf Richter. “Another collapsed SPAC, Lottery.com, discloses WTF horror list and says it will liquidate unless miracle happens.” Wolf Street, Aug. 16, 2022. entitled “Another collapsed SPAC, Lottery.com, discloses WTF horror list and says it will liquidate unless miracle happens” that 18 months after going public through a SPAC merger in February 2021, Lottery.com had “implode[d] and splinter[ed] into a million pieces amid investigations, fake accounting, unpaid payroll, missing cash, undisclosed debt, possible violations of state and federal laws, and a fired CFO.” Shares at the time of publication were trading at $1.00. In a July 29, 2022 filing with the SEC, the company reported that it could not meet payroll and had laid off a majority of its employees. In a later filing, the company reported that auditors had found $30 million was missing and there was $20 million in debt that had not been disclosed in year-end 2021 financial statements. Wolf concluded his article by answering the question of why the SPAC mania had occurred, stating the following:

… the benighted reckless money-printing by the Fed and by other central banks, combined with enormous stimulus payments sent by the government directly to consumers, businesses, and state and local governments created the greatest “anything goes” asset bubble ever that created the greatest consensual hallucination ever that was then brutally taken advantage by the people on Wall Street, in Silicon Valley, and elsewhere that engineered these SPACs and IPOs and crypto scams and crypto company IPOs, and the whole DeFi fiasco, and all the other stuff that many millions of people swallowed hook, line, and sinker, powered by said consensual hallucination.

SPAC Track in its August 13, 2022 weekly review claimed that the Zell SPAC liquidation was the seventeenth of 2022.

References

| ↑1 |

From Investopedia (Savings and Loan (S&L) Crisis) on the Savings & Loan Crisis:

|

|---|---|

| ↑2 | Catherine Austin Fitts. “Missing Money: A Personal History – 1989 to 2019.” The Solari Report, Apr. 7, 2019. |

| ↑3 | See Catherine’s book review of Bailout: How Washington Abandoned Main Street While Rescuing Wall Street by Neil Barofsky and “$29,000,000,000,000: A Detailed Look at the Fed’s Bailout of the Financial System.” |

| ↑4 | See John Titus, “Summary – Going Direct Reset.” |

| ↑5 | See “1st Quarter 2022 Wrap Up: Special Purpose Acquisition Companies (SPACs): Investment Craze or Deep State Laundry?” with Carolyn Betts, Esq. |

| ↑6 | See Michele Ferri and Jonathan Lurie, “FASAB Statement 56: Understanding New Government Financial Accounting Loopholes,” The Solari Report, December 29, 2018. |

| ↑7 | See Pam Martens and Russ Martens, “BlackRock authored the bailout plan before there was a crisis—now it’s been hired by three central banks to implement the plan,” Wall Street on Parade, June 5, 2020. |

| ↑8 | See “Look WHO’s talking! Vaccine scientists confirm major safety problems,” Children’s Health Defense, January 16, 2020. |

| ↑9 | See, for example, “Mapping Minneapolis Minnesota Riot Damage, Opportunity Zones, and Fed Banks (a Work in Progress).” |

| ↑10 | See John Titus’s video “Toilet-flushing the U.S. in 3 Exciting Fed Colors”; see also, “Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination.” |

| ↑11 | See the Solari Report’s “Missing Money” website. |

| ↑12 | See also Investopedia, “The Dangers of Share Dilution,” which explains: “Share dilution is when a company issues additional stock, reducing the ownership proportion of a current shareholder” and “Shares can be diluted through a conversion by holders of optionable securities, secondary offerings to raise additional capital, or offering new shares in exchange for acquisitions or services.” |

| ↑13 | For a description of the typical non-SPAC initial public offering, see Description of Traditional IPO. |

| ↑14 | Before the private company takes its shares public, shares are held by insiders in restricted form, meaning they cannot be sold in public markets or on exchanges. Insiders, thus, have an incentive to bring their company public in order that they may sell their shares in the open market and thereby value (for purposes of pledging as collateral, e.g.) and liquidate all or a portion of their investment in the company. |

| ↑15 | According to Michael Klausner, Michael Ohlrogge, and Emily Ruan, in their article “A Sober Look at SPACs” (Yale Journal on Regulation, 2022;39:228-303, footnote 17: Some post-merger companies struggle to meet stock exchange listing requirements for the minimum number of shareholders in a listed company. Nasdaq Rule 5505 requires at least 300 holders of round lots, defined as blocks of at least 100 shares. Rulebook, THE NASDAQ STOCK MKT., § 5505, Rulebook – The Nasdaq Stock Market. NYSE Listed Company Manual § 102.01A requires at least 400 holders of round lots. Listed Company Manual, NYSE, https://nyseguide.srorules.com/listed-company-manual. For instance, Xynomic Pharmaceuticals Holdings, Inc, which merged with the SPAC Bison Capital Acquisition Corporation in May 2019 disclosed in November 2019 that it had received notice of non-compliance with Nasdaq’s initial listing requirements for the minimum number of round lot holders. Xynomic Pharms. Holdings, Inc., Quarterly Report (Form 10-Q), at 5, 7 (Nov. 14, 2019). Nasdaq requires that post-merger SPACs re-certify compliance with initial listing requirements. NASDAQ Reference Library: Identification Number 1416, NASDAQ LISTING CTR. (Aug. 18, 2017), Reference Library – Advanced Search . |

| ↑16 | SPAC units are usually, or at least frequently, offered at $10, and the warrant exercise price is often $11.50. |

| ↑17 | For the sake of brevity, we refer to the combination transaction as a “merger,” even though the combination is sometimes achieved in the more complicated “reverse merger” or similar transaction. |

| ↑18 | See the “Shares Redeemed” column in the chart that can be found at Planet Equity SPAC Table. |

| ↑19 | Catherine tells the following story to illustrate stone soup. A guy walks into town and he has a stone. He unwraps it. They say, “What’s that?” He says, “It’s what you use to make stone soup.” Townspeople say, “Show us.” So he puts the stone in the hot water. Then he says, “I need carrots,” and the guy gets carrots. He says, “I need onions,” and he gets onions. Another guy brings a chicken. Before you know it, he’s got “stone soup,” except all he contributed was the stone. The $300 million in SPAC IPO proceeds that could be redeemed is the stone. |

| ↑20 | In other words, the public SPAC offering demonstrates to other market investors who might become PIPE investors in privately negotiated deals for the same SPAC shares the potential attractiveness in the market of the SPAC and a merger target it may identify. |

| ↑21 | See “SPAC Pros and Cons.” |

| ↑22 | Klausner et al., 2022, “A Sober Look at SPACs,” available at https://openyls.law.yale.edu/bitstream/handle/20.500.13051/17930/06.%20Klausner%20Article.%20Final.%20228-303.pdf?sequence=5. An abbreviated or draft version dated November 19, 2020 can be found at A Sober Look at SPACS. Apparently, an earlier draft version was posted in October 2020. We have not attempted to compare the articles’ contents. It is notable that this article has been cited by SEC regulators. Citations herein to “A Sober Look at SPACs” or “A Sober Look…” refer to the 2022 above-cited article. |

| ↑23 | Kamala Harris famously declared that one-third of small businesses closed during the pandemic. Later estimates were lower. An Austin-American Statesman fact check article (Fact-check: Have one-third of US small businesses closed during pandemic?) claimed the percentage was closer to 31% and that those were not permanent closures. A later headline in The Wall Street Journal (for an article unavailable to non-subscribers) indicated fewer closures were permanent than previously reported and used the figure of 200,000 during first year of the pandemic (Covid-19’s Toll on U.S. Business? 200,000 Extra Closures in Pandemic’s First Year). CNBC online, in April 2021, said the high was 23% of small and medium-sized businesses in May (presumably, May of 2020, and who knows if that was permanent?) (U.S. small business closures are ticking back toward Covid pandemic highs). The World Economic Forum website says that in May 2021, 34% of U.S. small businesses were closed due to Covid-19 (34% of America’s small businesses are still closed due to COVID-19. Here’s why it matters). According to the County Business Patterns section of the U.S. Census website CBP Tables—for which 2021 data are not yet available—the total number of U.S. small businesses did not change significantly from 2019 to 2020. This may be due to the creation of new businesses, however. We all know of many small businesses that closed in 2020, never to reopen. |

| ↑24 | CARES Act Wiki. |

| ↑25 | See, for example, President Biden Announces American Rescue Plan. For a funding breakdown of the American Rescue Plan Act, see the National Association of Counties website. |

| ↑26 | See Catherine Austin Fitts, “Control Is One Person at a Time,” Solari Report, January 14, 2022. |

| ↑27 | See “DOD and HUD $21 Trillion Missing Money: Report & Supporting Documentation.” |

| ↑28 | See SPAC Table. |

| ↑29 | See “Selected DeSPAC Data” in DeSPACS. |

| ↑30 | See “JPMorgan Chase: Selected Legal, Regulatory, and Enforcement Settlements, 2002 to 2019.” |

| ↑31 | See “JP Madoff with Helen Chaitman.” |

| ↑32 | https://spacinsider.com/ |

| ↑33 | Kirkland & Ellis. |

| ↑34 | Note that some target company SEC filings are linked on the DeSPAC Table at Planet Equity DeSPAC. The proxy statements filed by target companies when shareholders are to vote on proposed SPAC mergers include information on the identities of insiders and 5% shareholders. |

| ↑35 | The dominance of hedge funds in the purchase of SPAC shares and warrants is confirmed in the March 11, 2022 article in Institutional Investor, “As SPAC bubble burst, hedge funds doubled their holdings” by Michelle Celarier. |

| ↑36 | See “A Sober Look…,” page 9. This compares with the median cash delivered to the target of $151.6 billion (71.5% as a percentage of SPAC IPO proceeds) and a median target post-merger capitalization of $501.6 billion. |

| ↑37 | In this regard, see Jon Sindreu, “It’s official: SPACs are the new money-market funds,” The Wall Street Journal online, February 9, 2022 . |

| ↑38 | This is an outlier among SPACs, due to the fact that much of this investment, and, therefore, the run-up in stock price, is due to politically motivated support for former President Trump. Interestingly, while SPAC blank-check offerings are not supposed to have identified any target at the time of the IPO closing, this appears not to have been the case for Digital World Acquisition Corp., which was known to have targeted (at least informally) the Trump social media company early on. We leave that issue to SEC enforcement staff members. |

| ↑39 | A Sober Look…,” page 233. |

| ↑40 | “A Sober Look…,” page 248. |

| ↑41 | For a summary, see “Proposed SEC Regulations.” |

| ↑42 | Public Company Accounting Oversight Board (PCAOB) auditing standards (see PCAOB) are stricter than the Generally Accepted Accounting Principles (GAAP) established by the Financial Accounting Standards Board (FASB) (see GAAP) usually applied in financial audits. For a good summary of the various governmental and private accounting standards, see the July 17, 2017 Congressional Research Service paper by Raj Gnanarajah, “Accounting and Auditing Regulatory Structure: U.S. and International.” |

| ↑43 | See John Coates and Paul Munter, “Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies (‘SPACs’),” SEC, April 12, 2021, and Joel L. Rubinstein, Jonathan P. Rochwarger, Elliott M. Smith, and Daniel Nussen, “Clarity Emerges in the Aftermath of the SEC Statement on SPAC Warrant Accounting: A Roadmap for the Changes to Permit Equity Classification,” White & Case Publications & Events. |

| ↑44 | See “Titus Unpacks the Lies on the US Coin Shortage.” |

| ↑45 | See “Timeline of Key Economic Events of the Going Direct Reset.” |

| ↑46 | Lina Saigol, “Bill Ackman winds down $4 billion SPAC after failing to find suitable target.” Barron’s, Jul. 12, 2022. |

| ↑47 | Bailey Lipschultz. “Billionaire Sam Zell-backed SPAC to return cash to investors.” Bloomberg, Aug. 9, 2022. |

| ↑48 | https://www.bloomberg.com/authors/AS35PgNdMGI/bailey-lipschultz |

| ↑49 | Wolf Richter. “Another collapsed SPAC, Lottery.com, discloses WTF horror list and says it will liquidate unless miracle happens.” Wolf Street, Aug. 16, 2022. |